What is a family office?

Family offices originated in the USA. During the second half of the nineteenth century, wealthy families like the Rockefellers and the Whittiers created them to manage their assets.

The original family offices mainly existed to manage property. However, the industry developed rapidly as clients’ needs became increasingly complex, with family offices taking on a more general role overseeing all of a family’s personal and professional assets.

Today, the USA has an estimated 4,000 family offices managing $1,000 billion (source PwC). The industry is less developed in Europe, which accounts for 20% of the market (compared to 75% for the USA). The reasons for this are undoubtedly cultural.

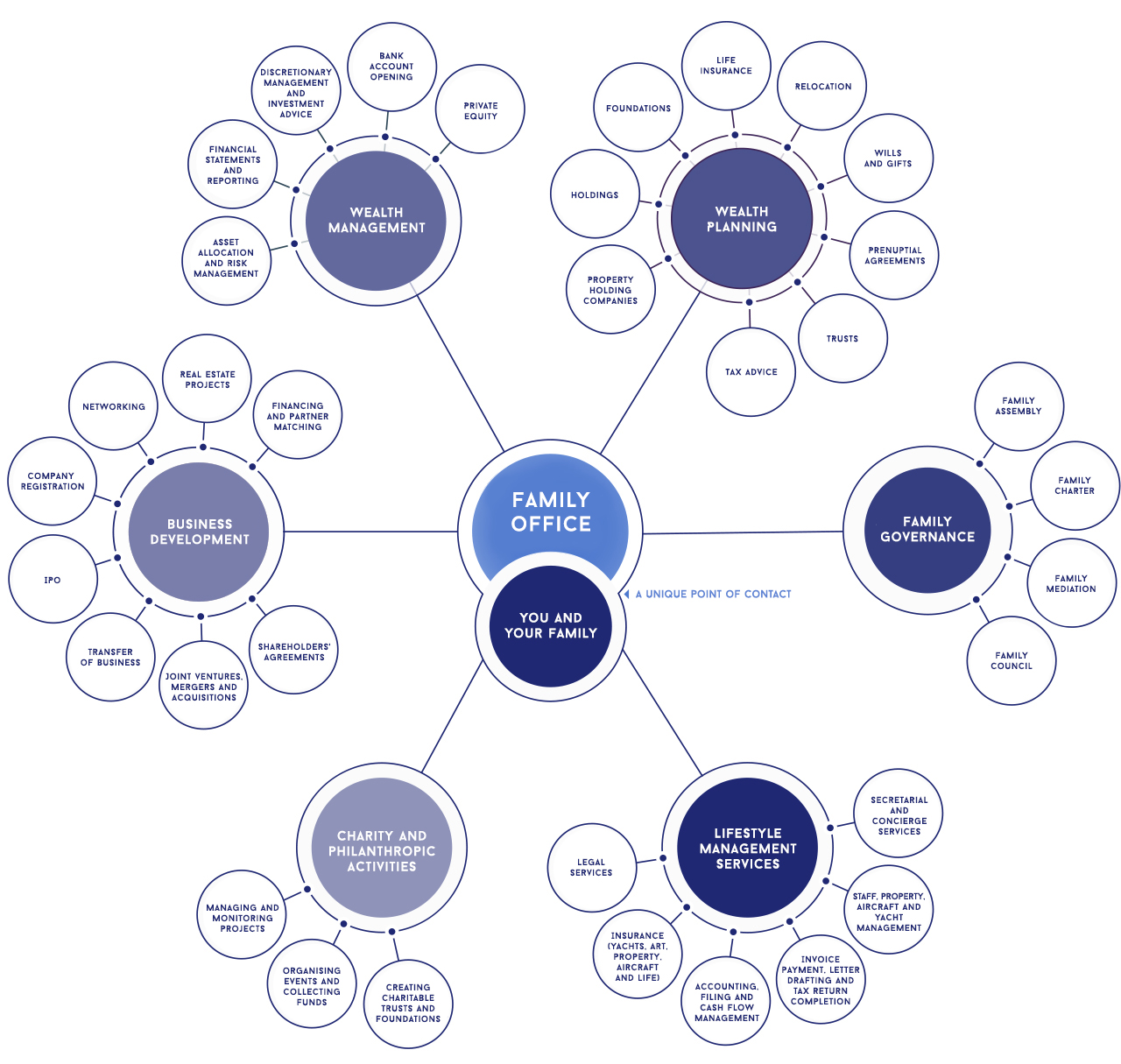

Family offices provide a wide range of services, which differ from one office to another. Services generally reach beyond managing assets (securities portfolios, property, yachts, etc.) to encompass legal services

(such as tax planning and contract drafting) and accounting, asset planning and even general support (such as travel bookings and staff management).

Some offices look after the affairs of a single family (single-family office) while others such as Onyx & Cie SA work with several families (multi-family office).

It is important to be aware that many family offices are linked to banks and cannot therefore offer a fully independent service.

Not only does each company provide a specific range of services, specialising in certain areas, but every one has its own style and culture. Consequently, families need to analyse their needs carefully and choose the family office best placed to meet them.

What can I expect from a family office?

Once a family acquires a certain level of wealth, members can find themselves tied up with wealth management, unable to enjoy their assets and with no time to spend on what is really important – other members of the family. They also run the risk of engaging numerous different advisers, thereby incurring high costs.

Family office services are ideal for people whose family assets are complex due to their nature (companies, property, aircraft, yachts, etc.), size or location (often spread across a number of countries) and who wish to sustain the value of their assets in the long term and to pass them on to future generations.

Family offices have a dual purpose: they work to maintain harmony within the family while also protecting and growing the family’s wealth.

The main benefit of a family office lies in the team of advisers and specialists who work side by side, hand in hand, so that the office has a complete vision of the family’s assets and becomes a single point of contact for managing their affairs.

Every family is unique and consequently family office services are always bespoke. There is no “one size fits all” solution.

What about cost?

Running a single-family office is very costly, as it involves employing an expert team of lawyers, accountants, wealth managers and other specialists according to the family’s needs.

Consequently, these days, most wealthy families choose to work with a multi-family office. As well as the vast cost savings, a family opting for a multi-family office has access to a wider team of specialists and also benefits from the experience the team acquires while working with other families.

Family office services are billed either on a time-spent or a fixed annual fee basis. In some cases, the two fee structures may be combined.

Fee levels will depend on the services required, the assets under management and their complexity and the staff member selected to manage them.

External advisers’ fees will be due in addition to those charged by the family office. However, family offices generally have excellent relationships with external advisers and depositary banks in particular, and may be in a position to negotiate preferential rates with them.

Follow Us