About Onyx & Cie SA

Onyx & Cie SA is a Swiss limited company headquartered in Geneva. It was created in 1993. The company is a member of the SAAM*, the Swiss Association of Asset Managers, and complies with its code of practice for independent asset managers. The company has its own premises and share capital of CHF 500,000.

Onyx & Cie SA is a closely held corporation. The majority of board members are from a single family. All are trained lawyers with extensive wealth management and banking knowledge.

Onyx & Cie SA belongs to the Croce & Associés group, an independent multi-family office with law firms in Geneva, London, Shanghai and Singapore, and a trust company in New Zealand. Furthermore, the group is working closely with an external asset manager based also in Singapore.

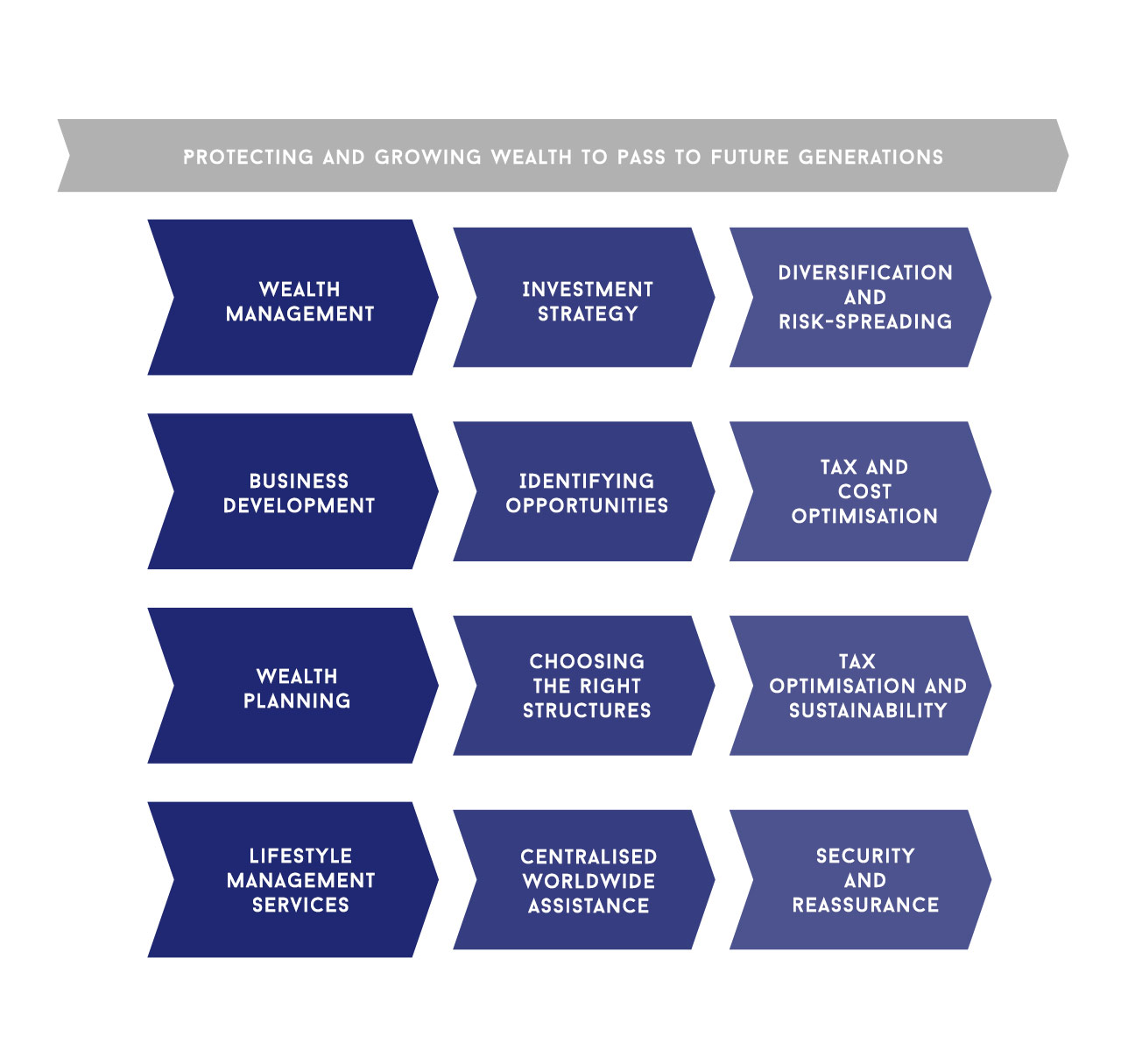

At Onyx & Cie SA, discretion and confidentiality are our watchwords. We specialise in wealth management, financial advice, tax planning and providing assistance with banking and financial operations of all types.

We offer our private clients the majority of the family office services required by high net worth families in Europe and Asia, such as comprehensive asset management, wealth planning and the creation of private holding companies, trusts and family foundations.

Our central office is on hand to help our clients with all their asset-related legal and financial questions and requirements as they arise.

At Onyx & Cie SA, we consciously limit the size of our clientele to guarantee that we can offer top-quality services to sustain capital, deliver performance and achieve innovation.

We have been working with most of our families for many years. Some are second-generation clients. We see this as proof of our ability to build lasting relationships with a demanding clientele.

“We are proud of our experience and independence. We consciously keep the structure of our operations open so that we can develop our services to suit our clients and adapt to change as it occurs.”

*SAAM is a self-regulating body approved by the Swiss Financial Market Supervisory Authority (FINMA) for the supervision of the financial intermediaries referred to in article 2 para. 3 of the Swiss Federal Law on combating money laundering and terrorism financing in the financial sector (AMLA). SAAM is also recognized by FINMA as a professional organization for laying down rules of conduct relating to the practice of the profession of independent asset manager within the meaning of the Swiss Federal Act on collective investment schemes.

Follow Us